Original date of the Spanish Thesis: 16-10-2020

History

The company was founded in 1999 by Tomasz Biernacki, currently the main shareholder with 51% of the shares. In that year he opened his first local store in the region of Wielkopolska, with the aim of offering in his business the proximity to the customer, quality and variety of food, cleaning and household products.

Given the growth and expansion of the number of stores, in 2002 they opened their first distribution center, which allows them to efficiently supply between 150-200 stores.

To improve the quality of meat and fresh products, in 2003 they acquired Agro-Rydzina, their main supplier since 1999. A strategic acquisition for the company, which gives them a cost advantage and improved margins.

In 2013, the company reached 300 stores and opened its second distribution center, continuing its national expansion at a growth rate of over 30% per year.

In 2017 the company goes public on the Warsaw Stock Exchange at a price of 39PLN, a figure that has multiplied almost X6 to date.

The company currently owns 1,300 stores across Poland and 5 distribution centers (2 more approved), evidencing the strong growth experienced to date and the potential it has for the future.

Key Ratios

As we can see in the image above, we are looking at a company that has grown at a rate of 30% since its IPO, with operating margins that have exceeded 7% in the last 12 months. Compared to giants such as Walmart (4%) or Costco (3%) they are much higher.

Its net profits have grown by 40% since its IPO, demonstrating the efficiency of the company's growth strategy.

It does not distribute dividends or buy back shares, nor does it plan to do so in the short term, as it prefers to reinvest in opening new stores, logistics centers and strategic acquisitions.

The Free Cash Flow shown in the image is negative, which is logical for a company that makes significant capital outlays to open new stores, logistics centers...

Finally, I would like to comment on the high ROIC of the company, growing year after year and practically touching 20%.

The last fact I would like to comment on is that half of the company's stores were opened in the last two years and do not reach their maximum level of maturity and profitability until 4 or 5 years have passed. So margins, profits and ROIC are expected to be much higher.

Business

Dino operates medium-sized supermarkets (400m2), stocking approximately five thousand different types of products, mostly fresh food and brand-name items, which are distributed through its own logistics centers that supply about 150-200 stores each. In addition, it differentiates itself from the competition by the quality of its fresh meats and sausages, with its own brand.

Dino Polska locates its supermarkets in towns with a maximum of 5,000 inhabitants. This means that in a very large number of villages there is no room for a competitor to position itself efficiently.

Dino's high cost efficiency would allow it to lower prices if necessary to put pressure on the competition. This would cause competitors to have to do the same in order to keep selling, lowering their margins and potentially incurring losses and thus being driven out.

Products

Product sales are distributed as shown in the graph below.

Thirty-eight percent of sales are of fresh food products, of which about 20% are of the Rydzina brand (owned by the company). This translates into around 7% of Dino's total sales as direct revenue for the company, with no intermediaries.

The other 62% of sales are distributed as 50% non-fresh food, beverages and tobacco and the remaining 12% in household cleaning products, personal hygiene and cosmetics of recognized Polish brands (only 2% are private labels).

The company benefits from these alliances with Polish suppliers in the form of scale, as it grows at the rate it does, it demands more and more products from its suppliers, which translates into lower prices and costs, reflected in growing operating margins.

The company's five distribution centers and working with local and local suppliers contribute to the company's low costs, as it is not dependent on external logistics operators or international suppliers. This also helps to ensure that the stores always have a full range of products.

Geographical area

100% of Dino's stores are in Poland, distributed as shown in the following image.

The growth strategy is clear: to open stores throughout Poland, locating close to consumers in towns of around 5,000 inhabitants. In the image above we can see that the central-western part of Poland has a fairly high number of stores, reaching in some territories the figure of 10 stores per 100,000 inhabitants, a strategic objective of the company for the whole country.

As we can see in both images, there is still a lot of room for growth and coverage.

This growth is achieved through the purchase of land or premises, which gives them a number of advantages over renting:

Greater flexibility in selecting locations.

Makes it more accessible to locate in small towns

Ease of establishing your own store format and design

Lower risks associated with leasing (all premises and land are owned).

Low maintenance, development and construction costs of stores

Potential to increase real estate value on previously low-value land.

Moats

In a business as competitive as supermarkets, convenience or convenience stores it is not easy to build a moat that will protect you from rivals for years, but the high ROIC and operating margins that Dino enjoys leads me to think that it must be doing something right, let's see what it is:

Scale: Dino has a cost advantage, thanks to many years of work by its management team. The company's own distribution centers mean that its logistics costs are very low.

High product turnover and long-standing relationships with local suppliers allow them, thanks to their trust, to buy products at increasingly lower prices.

Operating leverage also works in their favor, as fixed costs grow at a slower rate than revenues.

Being the owner of the meat company that supplies the supermarkets, which accounts for around 7% of the company's total sales, is another factor that contributes to higher margins.

They own their own premises, acquired on low-value land at a good price. This frees them from fixed monthly rental costs.

Barriers to entry: Dino Polska operates in towns that are too small for two supermarkets to be efficient. Its low costs, own premises, identical stores throughout the country to improve efficiency, staff with promotional skills and improved conditions make everything run very efficiently.

This means that in the event of the arrival of a new competitor, Dino can lower prices, remain profitable, cause the competitor to lower prices to continue selling with the consequent drop in margins, loss of profits and its consequent expulsion.

Arguably, Dino operates a kind of supermarket monopoly with which it is very difficult to compete.

Does the company have the capacity to raise prices? A picture says more than a thousand words

As we can see in the image above, the ability to raise prices is more than clear. They always raise them at a higher rate than the inflation of food products in Poland, without having to make continuous offers to liquidate inventory.

Future

The company currently has 1,302 stores and its growth plan is to continue opening stores nationwide. There are several factors that make me optimistic about the success of its strategic plan.

Since 2010, when it began its national expansion plan, the pace of growth has been continuous and financed mainly with the company's own profits.

The images of the geographical distribution and coverage (above) show that there is still a lot of territory to cover. In addition, the company's own management has the idea of opening one store for every 10,000 inhabitants, which brings us to an estimated figure of about 3,900-4,000 stores, about 3 times more than the current ones. What I cannot yet know is how many years they will carry it out, since their last expansion plan was planned in 2015 for 2020, and they comfortably fulfilled it in 2019. We will have to wait for the next annual report to see their next growth plans. Perhaps the following image will give us an idea of their future plans.

As we can see, in the last 10 years 1200 stores have been built, with the annual rate being higher and higher as they have more profits and more capacity to grow with little debt. In the first half of 2020 (and in the middle of the COVID 19 pandemic) they have built 84 stores, which gives us an estimated figure for the next few years of about 200 openings per year, which would bring us to about 2200 stores in 2025 (and I think that's too few).

Economic and social factors are also positive and favor the continued growth the company plans to make in the coming years.

Poland is the largest economy of the so-called CEE (Bulgaria, Slovakia, Hungary, Romania and Czech Republic) with a population of about 39,000,000 million inhabitants (44% of the CEE area), an unemployment rate that has dropped from 20% in 2008 to 5% in 2020, an average consumer spending per capita of about 640 euros per month, a very dispersed population and still very rural.

Finally, Poland's public debt is 50%, one of the lowest in Europe.

All these factors mentioned above give us an idea of the stability that Poland has been experiencing in recent years, with a relative tranquility in all the economic factors that surround it, better than the European average.

Consumer habits are increasingly focused on nearby and medium-sized stores, with a variety of quality and fresh products, without crowds in large hypermarkets, queues to wait at the butcher or delicatessen, difficulty in parking ....

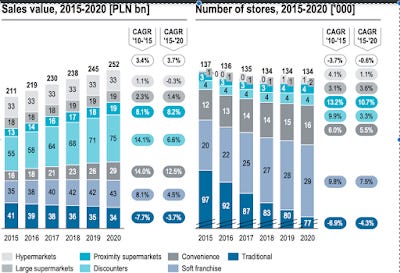

They are looking for a fast and convenient service, more weekly visits, without making large monthly purchases. We can see in the following image that these types of establishments are also enjoying an increasing market share and are gradually gaining ground over large establishments.

Competitors

The market in which Dino competes is wide, with many formats and with many companies fighting to gain market share (Dino has approximately 6%). It not only competes against convenience stores, but also against hypermarkets, supermarkets, convenience stores and discount stores. Therefore, we will make a global and a specific comparison.

Convenience-proximity

Zabka - is the undisputed leader, with some 6,000 stores across Poland and some in the Czech Republic. This gives us an idea of the number of stores DINO could have and its potential for international expansion. Unlisted.

Carrefour express - The French multinational is present in Poland with 900 stores, but divided into many different formats: 89 hypermarkets, 150 supermarkets, 600 convenience stores, 3 discount stores...and various formats. A giant, of which we will see numbers in the next point as it is listed on the stock exchange.

Polo Market - Polish company founded in 1997, which currently has 280 stores in Poland. It was born at the same time as Dino, but its growth has been much slower. It is not listed on the stock exchange.

Different formats

Biedronka - It is the absolute leader in terms of market share in Poland with around 3,000 supermarkets throughout the country and sales in 2019 of 12,621 million Euros. Its market share is about 45%. It is owned by the Portuguese company Jerónimo Martins.

Lidl - German supermarkets have 525 stores throughout Poland.

Tesco - 27 stores in Poland.

As we can see, it is a very competitive market, with many different formats with low margins and high product turnover. I would like to make a comparison of margins and different metrics with Polish competitors and such fabulous foreign supermarkets as Walmart, Alimentation Couche or Seven & I Holdings, in order to appreciate DINO's potential.

As we can see in the image above, it is far superior to businesses in the same sector, although in more mature stages. Its ROIC margins of almost 20% and its growing operating margins give it competitive advantages that are superior to those of other companies in the sector and that I am confident will last in the coming years. In addition, its sales growth (30% CAGR) and profit growth (44% CAGR) are also encouraging.

Management

The management, led by founder Tomasz Biernacki, is one of the company's strengths. Let's look at the reasons:

Share buyback/dividend payout

The company has not repurchased shares in recent years, except in the first quarter of 2020, at the height of the COVID-19 pandemic, when its founder acquired 57,000 shares, a very small sum, considering that he already owned 50,160,000 shares, 51% of the company's total.

As for the distribution of dividends, he neither does nor has it in mind, preferring to invest his profits in growing and opening new stores.

Guidance

Not only does it deliver, it does so comfortably. Its expansion plan planned in the 2015 letters with a view to 2020 was already fulfilled in 2019, with higher-than-expected margins. It now expects for the next few years an expansion of 1 store per 10,000 population, I don't doubt it will deliver, but we will have to wait for next year's letter to see its 5-year expansion plan.

Skin in the game

As I mentioned above, the company's founder owns 51% of the shares, in addition to receiving no salary, so his alignment is unquestionable.

The key managers of the company have fixed salaries ranging from 150,000-500,000 fixed + targets, which can reach up to 1 million euros if they are met, and this has been the case in recent years, rewarding the great performance to date.

Debt

The company finances a large part of its growth with the Cash Flow generated year after year, although it is true that they have requested bank loans for their growth.

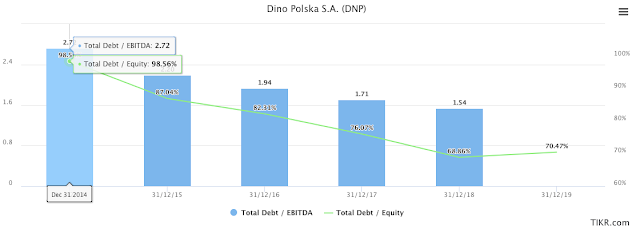

Its Debt/Equity ratio is 0.7 and its Debt/EBITDA ratio is 1.57, always decreasing year after year and being one of the lowest in the sector, as we can see in the following graph. This is mainly due to the fact that as it has more profit each year, its debt/EBITDA ratio is lower.

Finance

Balance sheet

The company's assets have grown over the last 5 years from Zloty 1.1 billion to Zloty 4.35 billion presented in the latest 2019 accounts. Of these assets, 268 million correspond to cash on hand and 2733 million to property, which although not a liquid asset, I like to emphasize, because its book value is much lower than its actual value, since these purchases of land and premises are accounted for at their acquisition value and not their current value which is estimated to be much higher.

The company's debt has also increased, but in a conservative and controlled manner as mentioned above and currently amounts to Zloty 1,143 million. Given that it has cash of 268 million, equity of 1622 million and all this debt is long-term, it has no liquidity or bankruptcy risk.

Income statement

I think it is better to see it in a graph than to describe it.

Growth of almost 30% per year in recent years, profits at 44%, operating margins above 7% in an industry noted for low margins. Some of the best numbers in the industry for a company with strong growth ahead.

Valuation

Although the company has had spectacular growth and margins, we are going to make a conservative valuation between now and 2025, estimating growth of 20% per year on average, operating margins of 9% and a P/E of 30.

With these numbers, we get an estimated and conservative figure of around 500-600 Zloties, which at current prices offers a return of approximately 15%.

Conclusion

Despite being a company in a very competitive sector, its growth capacity is still very large, very well managed, with the highest margins and growth percentages worldwide. With Skin in the game by its founder, conservatively financed and generating profit year after year.

Their high barriers to entry will protect them from competition in the long term and allow them to continue to expand their margins.

With a long term vision, we would find ourselves in front of an investment with a lot of potential, perhaps currently trading at a somewhat high P/E, but given the quality of the business, very fair. Undoubtedly, an opportunity to take into account, as long as, I repeat, the vision is long term and monitoring it year after year to see how its expansion plan continues.

DISCLAIMER: This analysis is not a buy or sell recommendation, each person should do their own research before making any kind of investment.

This stock has now been picked up by a lot of great investors... but you seem to have been earlier or perhaps first (congrats!). How did you find this stock, if I may ask? And secondly, have you thought of when you might sell? I'm asking because if their TAM is double their current domestic store count, that means we should probably expect growth to continue slowing and the multiple to start shrinking from a growth multiple to a value multiple. Unless of course they find a new way to deploy capital (something significant and proven) but I don't think we have that right now (despite some promising plans related to the gas stations).

Thank you, this is a great overview of the company! Do you have a sense of the margins they generate on meat/deli?

Also, what is your estimate of operating margins of their mature stores vs. the overall ~8% operating margin Dino generates?